Summitpath Llp - Truths

Summitpath Llp Things To Know Before You Buy

Table of ContentsGetting The Summitpath Llp To WorkSummitpath Llp - QuestionsAn Unbiased View of Summitpath Llp6 Easy Facts About Summitpath Llp Described

Most recently, launched the CAS 2.0 Method Development Coaching Program. https://www.empregosaude.pt/author/summitp4th/. The multi-step mentoring program consists of: Pre-coaching placement Interactive team sessions Roundtable conversations Embellished coaching Action-oriented mini prepares Firms aiming to broaden into advisory services can also turn to Thomson Reuters Method Onward. This market-proven approach uses material, devices, and support for companies curious about consultatory servicesWhile the modifications have actually unlocked a number of development opportunities, they have also resulted in challenges and concerns that today's companies need to have on their radars., companies need to have the capacity to rapidly and successfully perform tax research study and enhance tax reporting performances.

Additionally, the new disclosures might lead to a boost in non-GAAP procedures, historically an issue that is extremely scrutinized by the SEC." Accountants have a lot on their plate from governing modifications, to reimagined business models, to a boost in client assumptions. Keeping pace with it all can be difficult, yet it does not need to be.

See This Report on Summitpath Llp

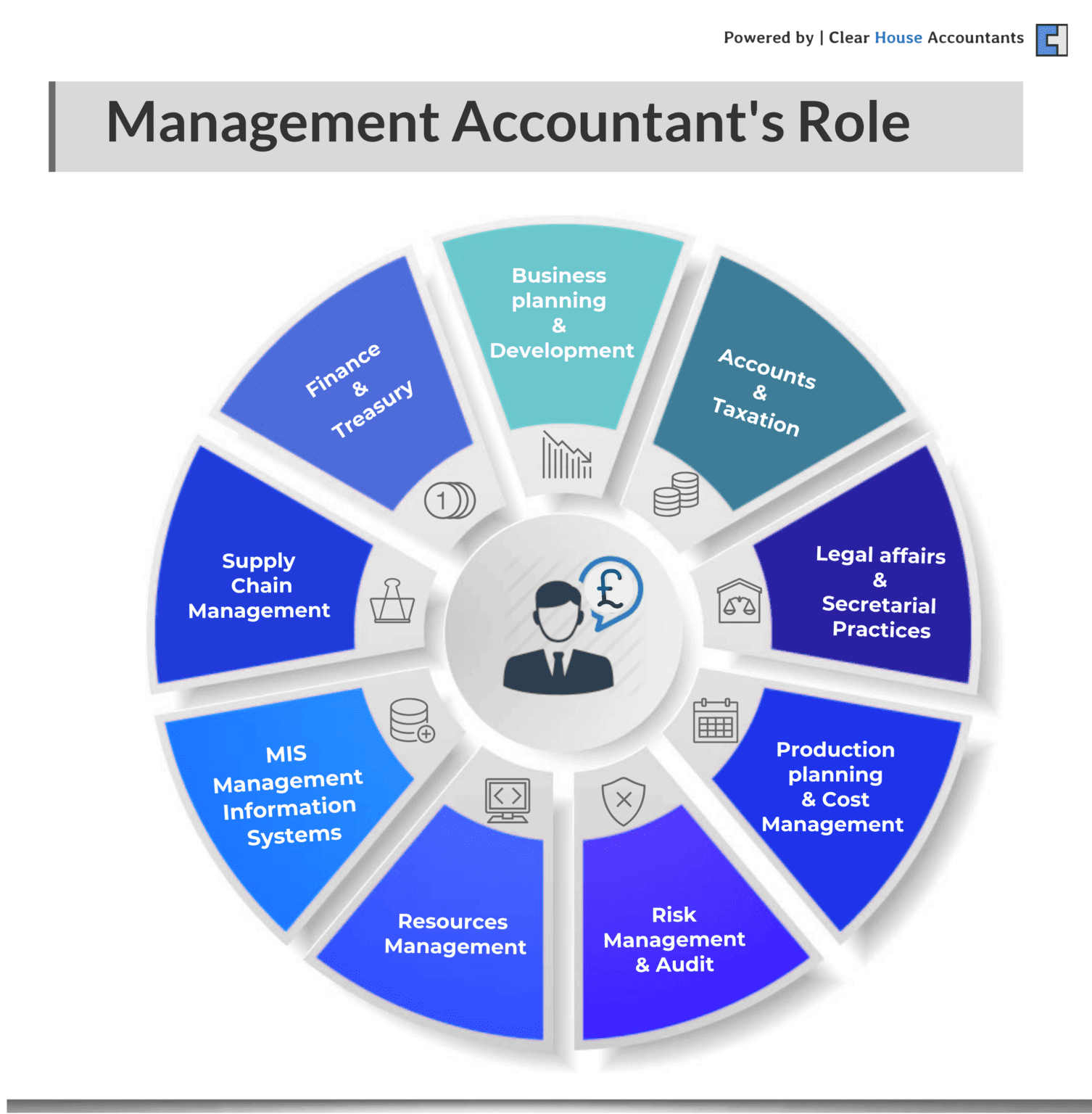

Listed below, we define 4 certified public accountant specializeds: tax, administration accounting, monetary coverage, and forensic accounting. Certified public accountants focusing on taxation assist their customers prepare and submit income tax return, lower their tax burden, and avoid making errors that can bring about pricey penalties. All Certified public accountants require some expertise of tax regulation, but focusing on taxes means this will be the emphasis of your work.

Forensic accountants normally start as general accountants and move into forensic audit roles with time. They require solid analytical, investigatory, business, and technological accountancy abilities. Certified public accountants who concentrate on forensic accounting can in some cases go up into monitoring audit. CPAs require a minimum of a bachelor's degree in bookkeeping or a comparable area, and they need to complete 150 credit history hours, consisting of accountancy and organization courses.

No states need a graduate degree in accountancy., auditing, and tax.

And I suched as that there are whole lots of various work choices which I would not be out of work after college graduation. Accountancy additionally makes functional feeling to me; it's not just academic. I such as that the debits constantly have to amount to the credit histories, and the annual report has to balance. The CPA is a vital credential to me, and I still get continuing education credit reports yearly to stay up to date with our state requirements.

Fascination About Summitpath Llp

As an independent professional, I still utilize all the basic structure blocks of accounting that I learned in college, pursuing my CPA, and operating in public accountancy. Among the points I really like regarding accounting is that there are several tasks available. I chose that I intended to start my profession in public bookkeeping in order to find out a great deal in a short time period and be subjected to various sorts of clients and various locations of accountancy.

"There are some workplaces that don't intend to take into consideration a person for an audit duty who is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a really useful credential, and I intended to position myself well in the market for different work - CPA for small business. I made a decision in college as an audit major that I intended to attempt to obtain my CPA as quickly as I could

I have actually fulfilled lots of terrific accountants who don't have a CPA, yet in my experience, having the credential really assists to advertise your experience and makes a difference in your compensation and career alternatives. There are some offices that don't desire to consider someone for a bookkeeping function that is not a CERTIFIED PUBLIC ACCOUNTANT.

What Does Summitpath Llp Do?

I actually appreciated servicing numerous kinds of jobs with different clients. I discovered a lot from each of my coworkers and customers. I dealt with various not-for-profit companies and found that I want mission-driven companies. In 2021, I chose to take the next step in my bookkeeping profession journey, and I am currently a self-employed accounting expert and service expert.

It proceeds to be a growth area for me. One crucial top quality in being a successful CPA is really appreciating your customers and their services. I enjoy working with not-for-profit clients for that extremely factor I really feel like I'm really contributing to their objective by helping them have great monetary details on which to make smart company decisions.